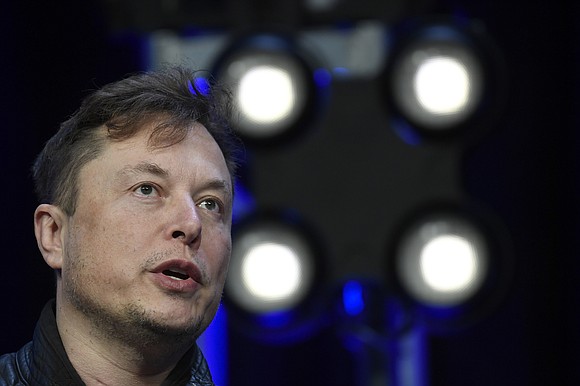

Tesla subpoenaed over Elon Musk's tweets ... again

CNN/Stylemagazine.com Newswire | 7/25/2022, 1:49 p.m.

Originally Published: 25 JUL 22 09:00 ET

Updated: 25 JUL 22 14:43 ET

By Chris Isidore, CNN Business

(CNN) -- The Securities and Exchange Commission apparently isn't done with Elon Musk and his tweets quite yet.

Tesla disclosed in a quarterly regulatory filing Monday that it received a new subpoena from the SEC on June 13, related to "our governance processes around compliance with the SEC settlement." That settlement, which stripped Musk of his title as chairman of Tesla while allowing him to remain as CEO, came because of Musk's 2018 tweet that he had "funding secured" to take Tesla private.

The SEC charged that despite discussions with Saudi investors, Musk did not have the funding secured to take Tesla private. As part of that settlement, Musk agreed to the charge and also agreed to submit any future tweets containing information that could be material to investors to other executives at Tesla for approval.

Musk has been bitterly critical of the SEC since that settlement. At a TED conference earlier this year, Musk said he agreed to a settlement only because if he continued to fight the agency, Tesla's banks would have cut off funding at a time when it needed cash.

"I was forced [to lie] to save Tesla's life and that's the only reason," Musk said at the TED conference in April.

He went on to compare the experience to having someone point a gun to his child's head.

Musk's lawyers also filed complaints with the federal judge overseeing the settlement complaining that the SEC is attempting to "chill his exercise of First Amendment rights" because Musk is an "outspoken critic of the government."

In addition to its investigation of Musk's role at Tesla, the SEC is looking into his tweets about his effort to buy Twitter. The agency sent a letter to Musk on June 2 with questions about his tweets related to the buyout effort, including his those about the deal being paused, according a Thursday regulatory filing. The agency had already questioned Musk in an April letter about his apparent delay in disclosing his large ownership stake in Twitter.

Tesla had previously disclosed a subpoena related to an SEC probe of the settlement in November 2021. Tesla wrote in the Monday filing that the company "routinely" cooperates with regulatory and governmental probes, including subpoenas. The SEC did not have a response to questions about its latest subpoena to Tesla.

Also in Monday's filing Tesla provided more details about its cryptocurrency holdings. The company said its remaining bitcoin and other crypto currency assets had a carrying value of $218 million as of June 30, down from $1.26 billion at the end of last year. Last week in its earnings report Tesla disclosed that it had sold 75% of its bitcoin stake during the second quarter.

Bitcoin has lost nearly half of its value in the first half of this year. Tesla said it took a charge of $170 million for the loss in value of its crypto investments, while at the same time recording a $64 million gain on the holdings it did sell for more than their original purchase price.

During the call with investors last week Musk said the sale of bitcoin was prompted by the need to maintain the company's cash reserves due to costs from having its Shanghai plant shutdown for most of the quarter by Covid lockdowns. He also noted costs associated with starting up new plants in Texas and Germany which he previously described as "gigantic money furnaces" due to supply chain problems that kept their early output "puny."

Musk said the company had not lost faith in bitcoin, and noted that it had not sold holdings in another digital currency, dogecoin, during the quarter.

The company will have needs for additional cash going forward. The filing also disclosed plans to spend between $6 billion and $8 billion on capital expenses, such as equipment, construction and other large ticket items this year as well as the next two years. That's up $1 billion from the range it had previously said it planned to spend annually in those years.

— CNN Business' Clare Duffy contributed to this report.