General Motors Powers Through Q3 with Impressive $48.8 Billion Revenue

Jo-Carolyn Goode | 10/22/2024, 11:37 a.m.

It’s a good day to be General Motors. As Q3 2024 came to a close, the auto giant revved up a smooth ride through another successful quarter, leaving competitors in its rearview mirror. With total revenue hitting a whopping $48.8 billion, GM is shifting gears with determination, and here’s why Houston needs to pay attention.

While GM may be headquartered in Detroit, its impact ripples across the country, from corporate boardrooms to bustling car dealerships right here in Texas. It’s not just about selling cars—it’s about driving innovation, pushing sustainability, and ensuring they’re not just cruising the road but also leading the charge into the future of electric vehicles (EVs).

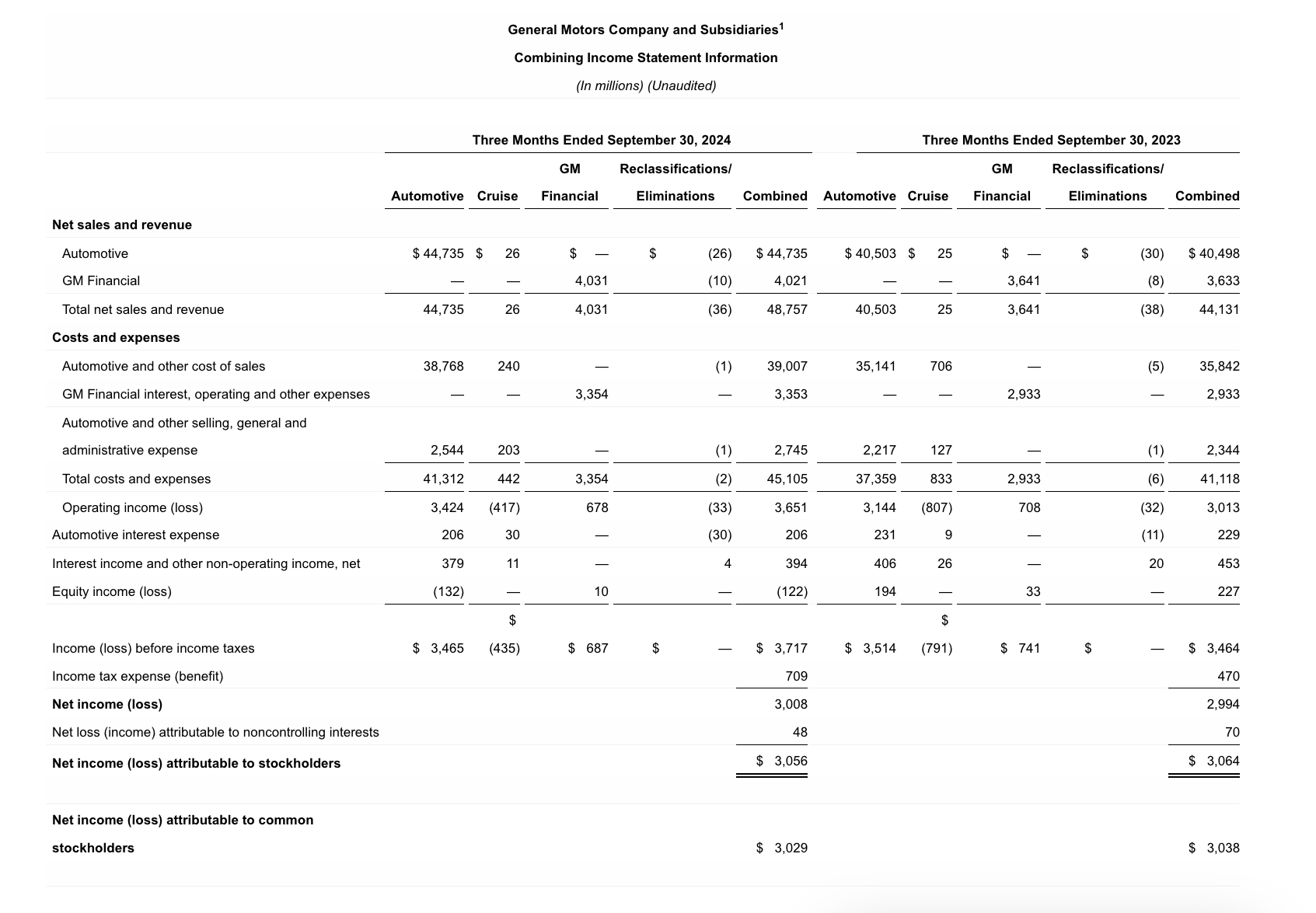

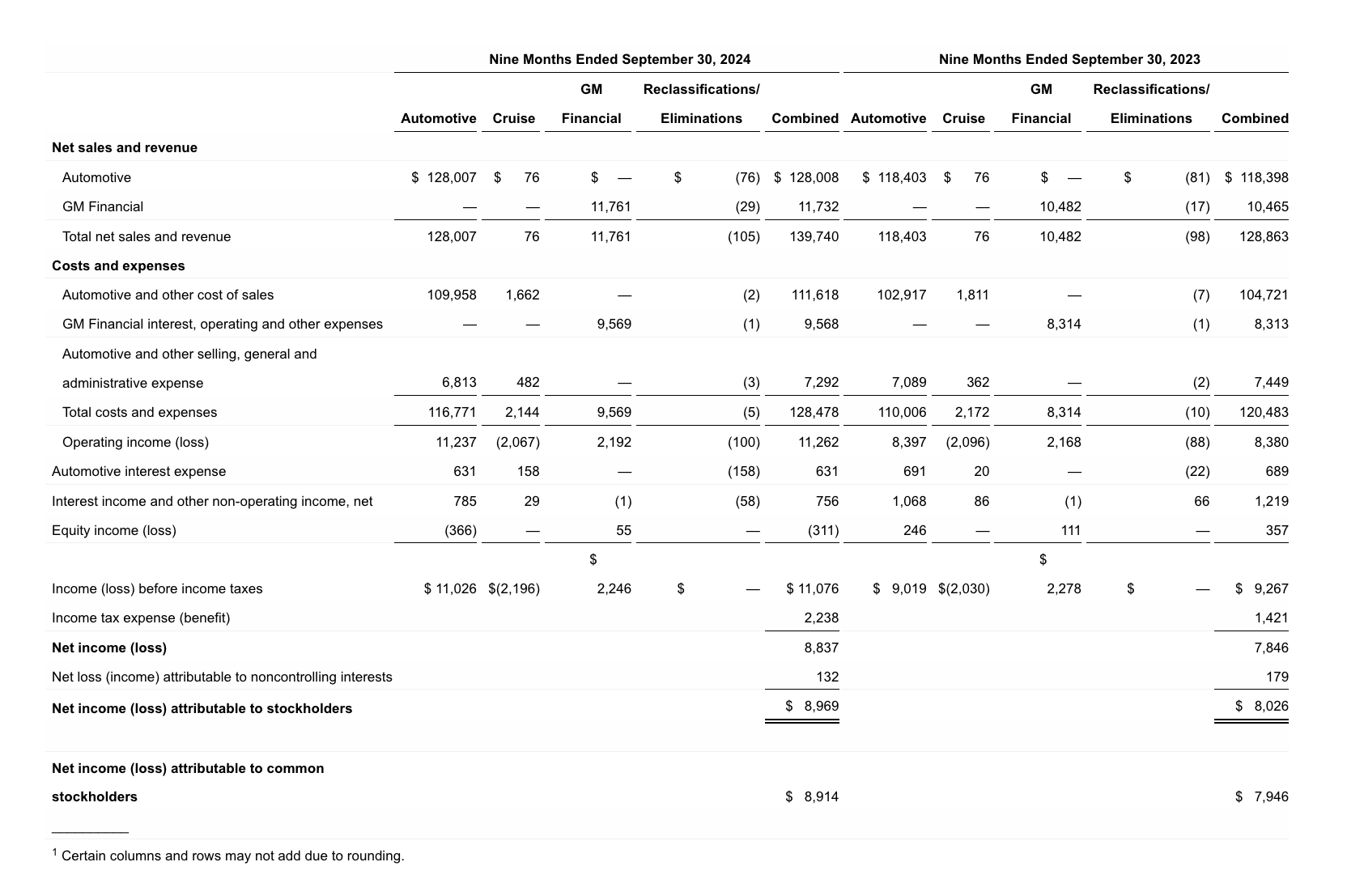

A Financial Pit Stop: Q3 Breakdown

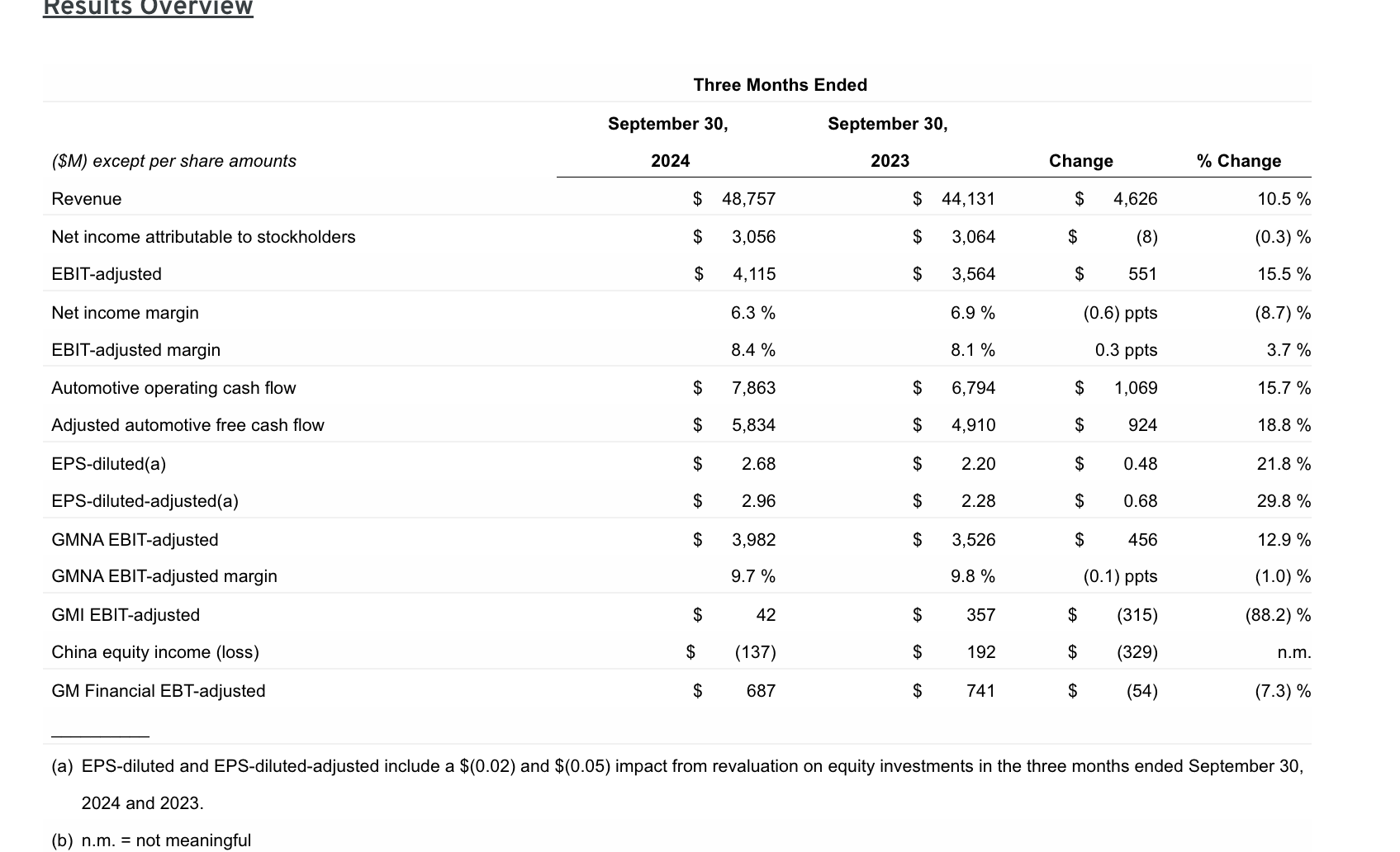

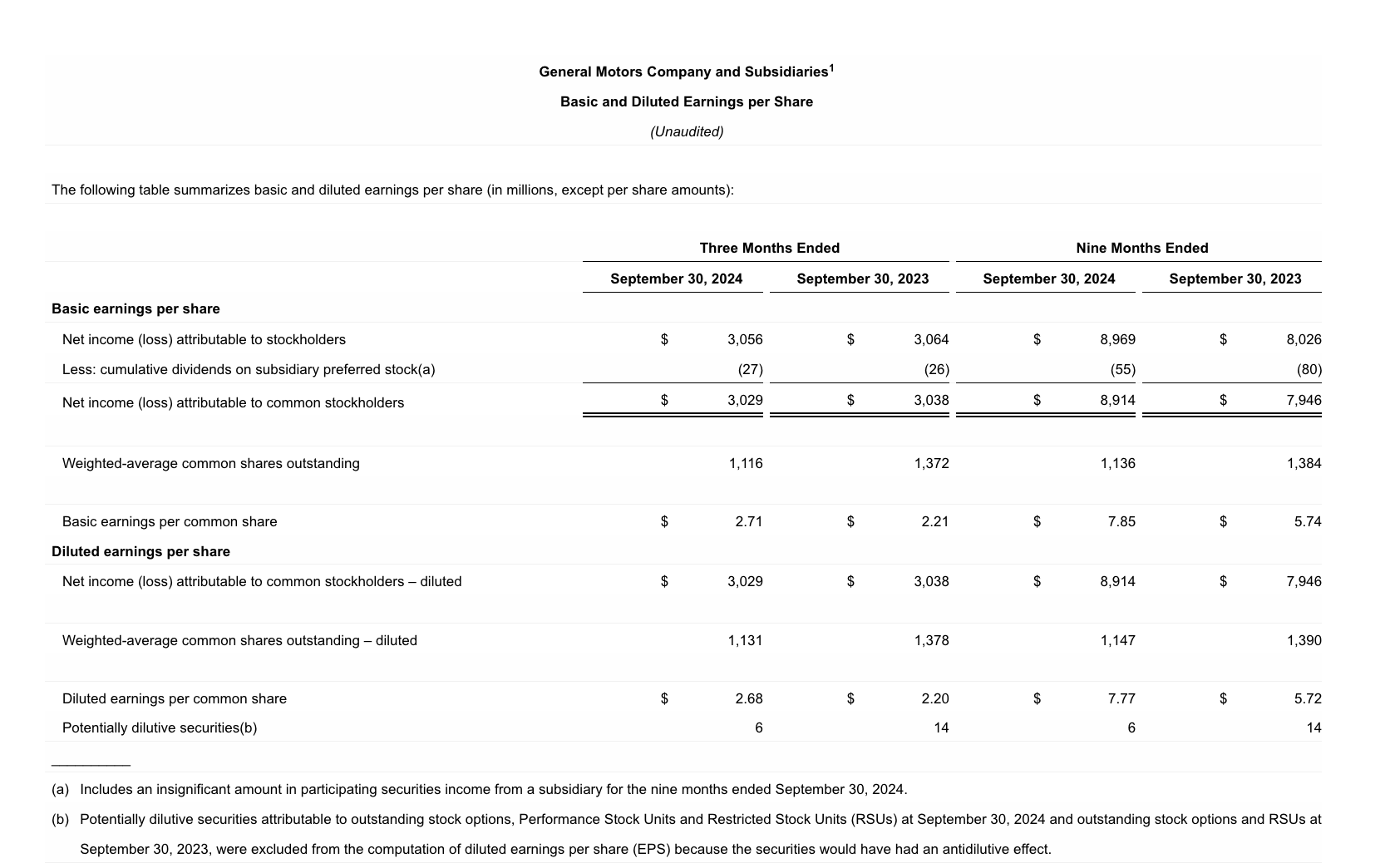

To put GM’s third-quarter report into perspective, net income for the quarter revved up to $3.1 billion. For those keeping score at home, that’s a cool increase that speaks to the company's ability to navigate a complex global market. But GM’s success isn’t just about fancy numbers—let’s talk EBIT (Earnings Before Interest and Taxes) adjusted, which hit a formidable $4.1 billion. These results underline the company's smart management decisions, operational efficiency, and continued resilience against industry challenges.

The Electric Revolution: More Than Just a Trend

Houston, we have a solution—and it’s electric! With gas prices still a rollercoaster and climate change concerns heating up, GM is driving forward with its electric vehicle (EV) portfolio. While many brands are hopping on the EV bandwagon, GM has been steering the way for years, accelerating their production of EVs that are just as powerful, luxurious, and stylish as their gas-powered predecessors.

With models like the Chevrolet Bolt, Cadillac LYRIQ, and the upcoming GMC Hummer EV, GM is making EVs that appeal to all walks of life, from eco-conscious Houstonians to those craving a bit of power and performance. And let's not forget how this shift aligns with GM's broader strategy to become carbon neutral by 2040. This isn’t just a trend—it’s the future, and GM is miles ahead in the race.

GM’s Impact on Houston: It’s More Than Cars

Here in the heart of Texas, GM's influence extends beyond selling cars. The company plays a key role in our local economy, from dealerships to repair shops and even tech jobs in autonomous driving and AI development. Houstonians are already getting a taste of GM’s future-forward thinking with electric vehicle charging stations becoming a regular sight, particularly as the company continues to invest heavily in infrastructure.

And it’s not just about vehicles and the environment; it’s about jobs. GM's expansion into new technologies means more opportunities for Houston's talented workforce, especially those in STEM fields who are looking to be part of the next big thing in transportation.

A Look Ahead: What Does Q4 Hold?

As GM rolls into Q4, all eyes are on what’s next. The market is volatile, but with the company's consistent performance, there's little doubt they’ll continue to steer towards success. With its laser focus on innovation and profitability, don’t be surprised if GM’s next quarter figures shift into even higher gear.

Key Takeaways: Why Houston Cares About GM’s Success

Revenue & Growth: GM’s strong Q3 performance showcases its resilience and smart management, setting a solid foundation for future growth.

Electric Vehicles: The company’s continued investment in EV technology promises a cleaner, more efficient future for both Houston and the world.

Jobs & Innovation: GM’s push into EVs and tech innovation means more local jobs, especially in STEM fields.

General Motors (NYSE: GM) continues to show why it's a titan in the auto industry, releasing a robust financial performance for the third quarter of 2024. With GM Chair and CEO Mary Barra and CFO Paul Jacobson scheduled to host an exclusive investor and analyst conference call, the numbers are already speaking volumes. So, buckle up, Houston! Here’s what you need to know about GM's latest earnings, the buzz from the call, and what it means for the future of the auto giant—especially as electric vehicles continue to charge forward.

The Numbers Don’t Lie: GM’s Q3 by the Billion

Coming in hot, GM posted a Q3 2024 revenue of $48.8 billion. That’s right—$48.8 billion. But wait, there’s more. The net income attributed to shareholders reached $3.1 billion, and EBIT-adjusted earnings hit an impressive $4.1 billion. If these figures are any indicator, GM is navigating the tricky global market with expert precision and continues to set benchmarks for the auto industry.

While many competitors have faltered amidst supply chain issues and market volatility, GM has revved its engines and stayed the course. The company’s stellar financial results are a testament to its resilience, adaptability, and relentless push for innovation—something that’s good news not just for investors but for GM enthusiasts in Houston and beyond.

All Eyes on Mary Barra: GM’s Visionary Leadership

Mary Barra is more than just the face of GM—she’s the driving force behind the company’s ambitious plans for the future. From the continued rollout of electric vehicles (EVs) to their vision for a carbon-neutral future by 2040, Barra’s leadership has been a masterclass in steering a century-old brand into uncharted territory.

And with CFO Paul Jacobson by her side, the dynamic duo will be diving into these exciting Q3 results during the conference call. Investors, analysts, and industry insiders will be tuning in at 8:30 a.m. ET today to hear their take on what’s driving GM’s growth, the company's future roadmap, and how it continues to lead the EV revolution.

How to Tune In: The Conference Call Details

For those ready to dial in, here are the conference call details:

U.S. Participants: 1-800-857-9821

International (Caller-Paid): 1-517-308-9481

Passcode: General Motors

During this call, Barra and Jacobson will unpack everything from earnings insights to strategic goals. And for those who can’t make it in real-time, fear not—an audio replay will be available on GM’s Investor Relations website, along with GM’s earnings deck and a letter to shareholders from Mary Barra herself.

Investors: Don’t Miss This!

Whether you’re an investor looking to strengthen your portfolio or simply an auto enthusiast interested in the company’s financials, this conference call is not one to miss. The details shared during this event could shed light on the strategies that have helped GM continue to rise above market challenges and outperform expectations.

Electric Vehicles Are Revving Up in Houston

Houston’s love affair with big trucks and SUVs may soon be eclipsed by GM’s next wave of electric vehicles. From the eye-catching Cadillac LYRIQ to the game-changing Hummer EV, GM is ensuring that Houstonians can enjoy the luxury and power they crave, all while reducing their carbon footprint.

For a city that prides itself on being both the energy capital and a hub for innovation, GM’s EV lineup is perfectly suited for Houston’s future. The company's ambitious plans to roll out more EVs are a clear signal that GM is ready to help lead the charge toward sustainability—both figuratively and literally.

What Does GM’s Success Mean for Houston?

GM’s financial success isn’t just great news for shareholders—it’s a win for Houston’s economy too. With GM-backed dealerships and service centers across the city, Houston’s auto industry thrives when GM does well. Jobs, tech opportunities, and a growing market for electric vehicles are just a few of the positive outcomes Houstonians can expect as GM continues to dominate the automotive landscape.

Cautionary Note on Forward-Looking Statements: This press release and related comments by management may include "forward-looking statements" within the meaning of the

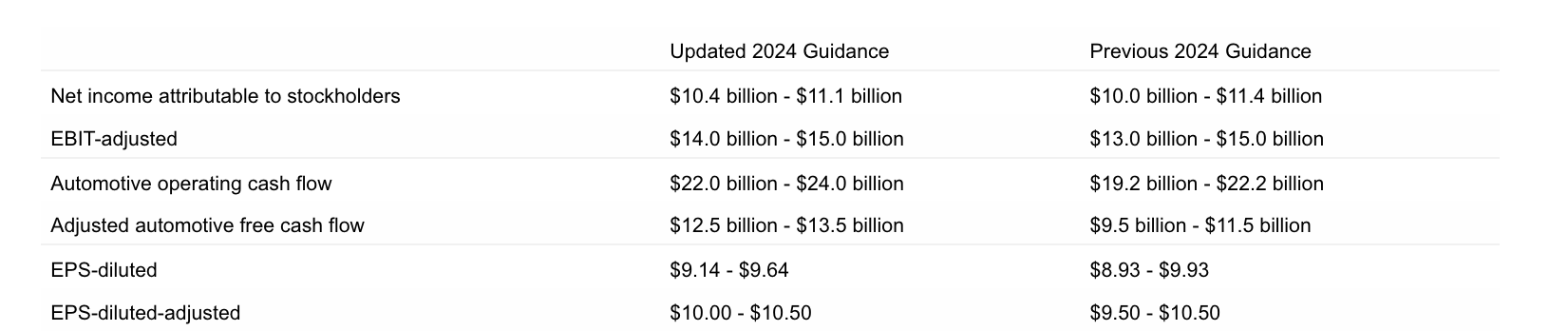

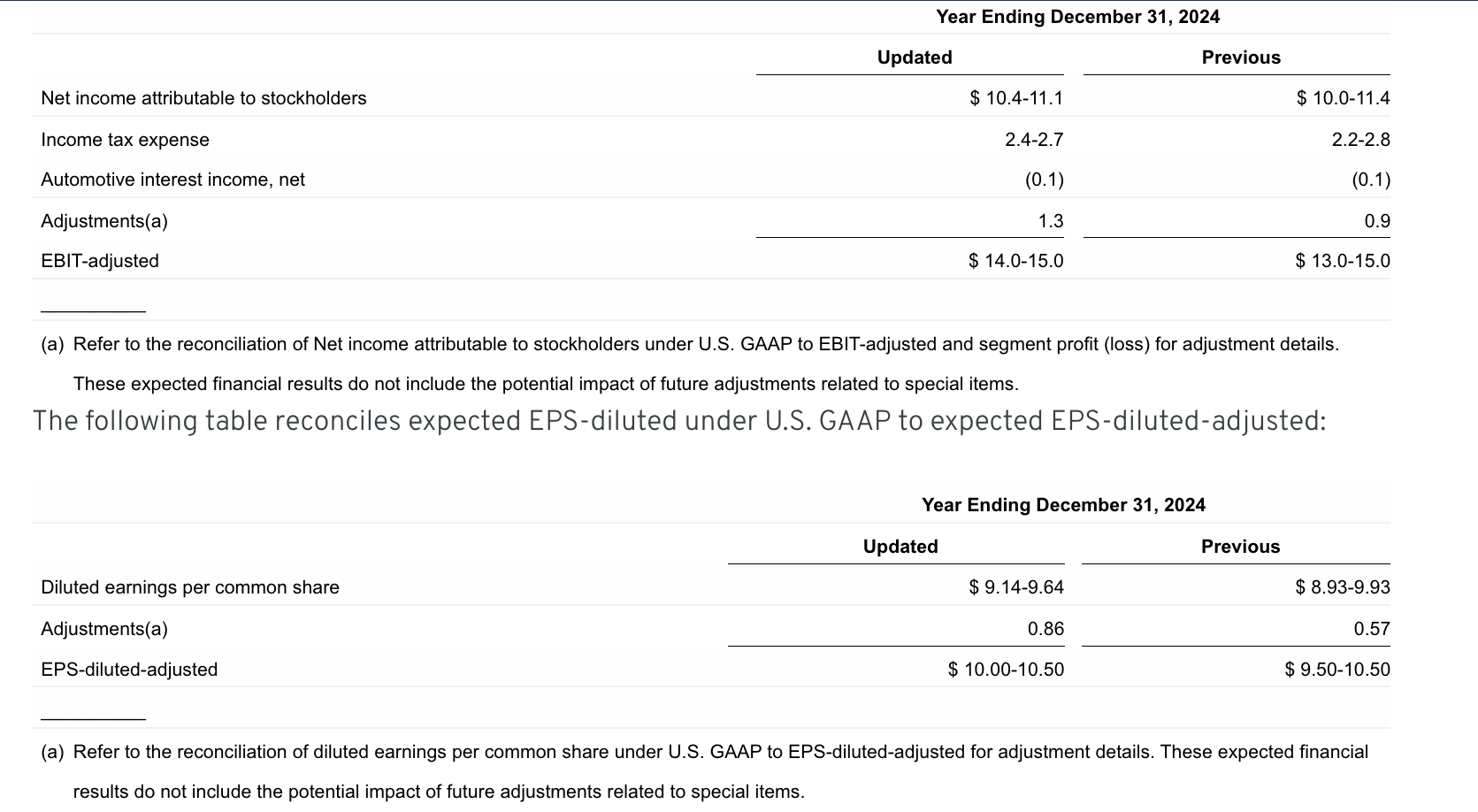

Guidance Reconciliations

The following table reconciles expected Net income attributable to stockholders under

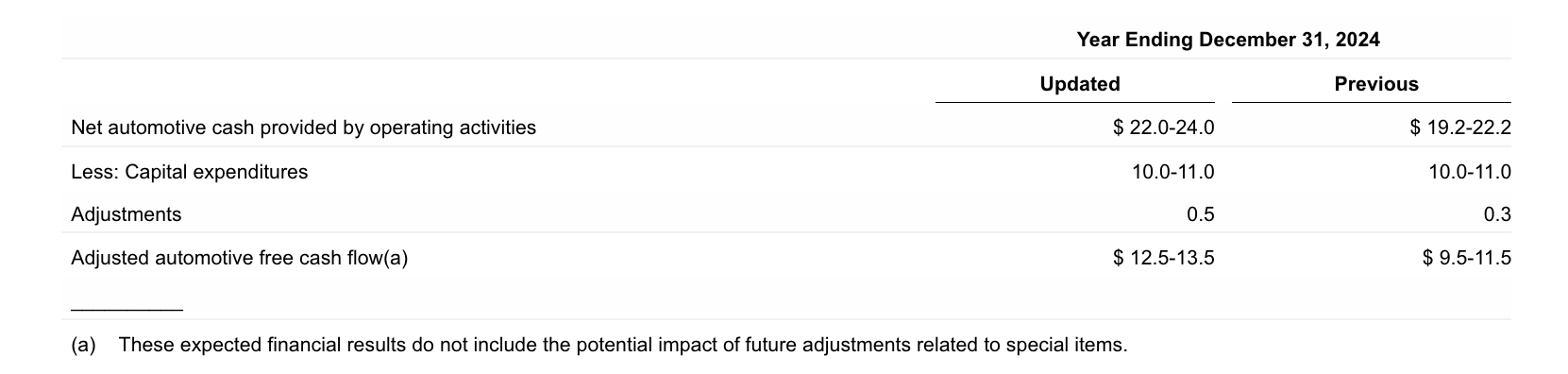

The following table reconciles expected automotive net cash provided by operating activities under

The following table reconciles expected automotive net cash provided by operating activities under

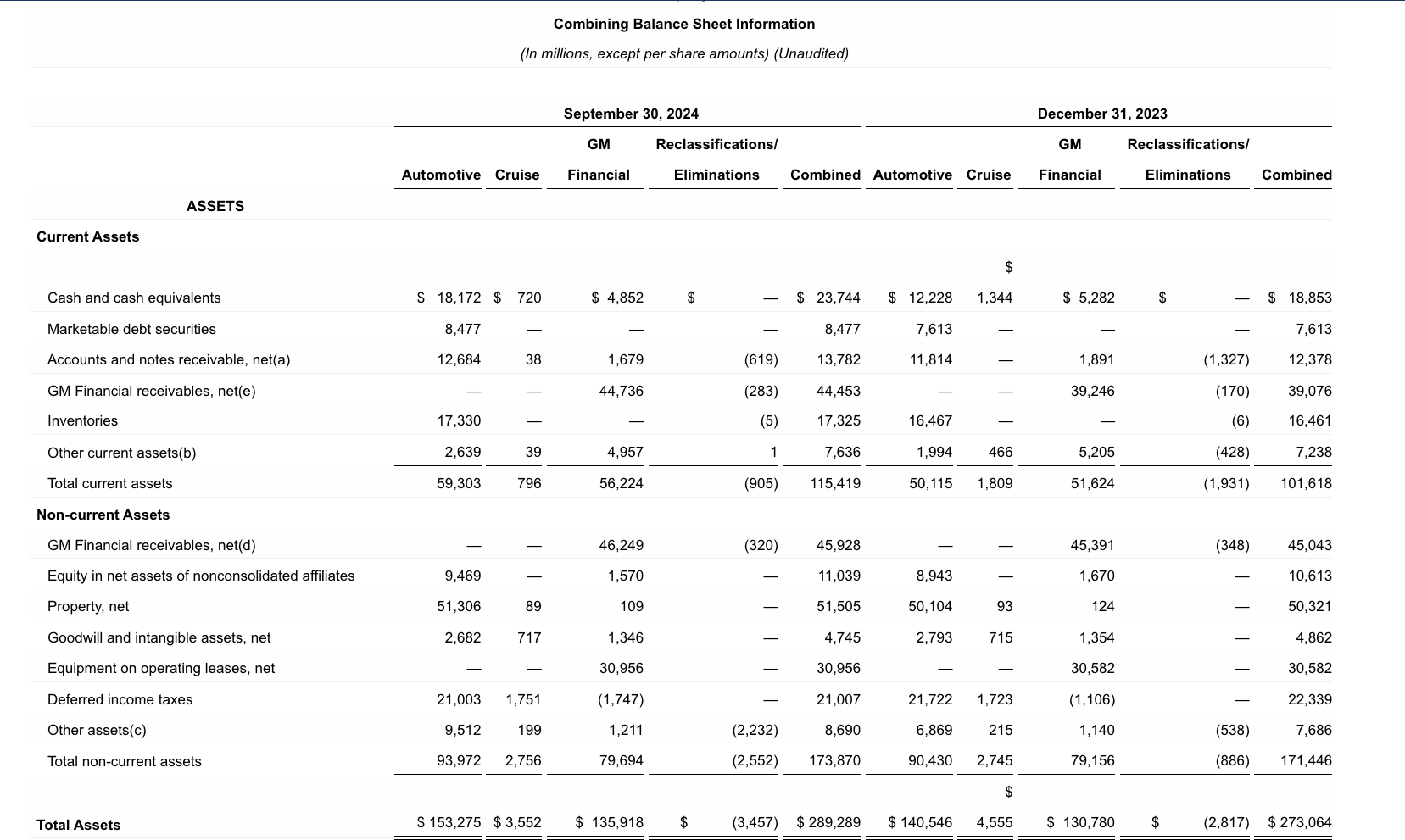

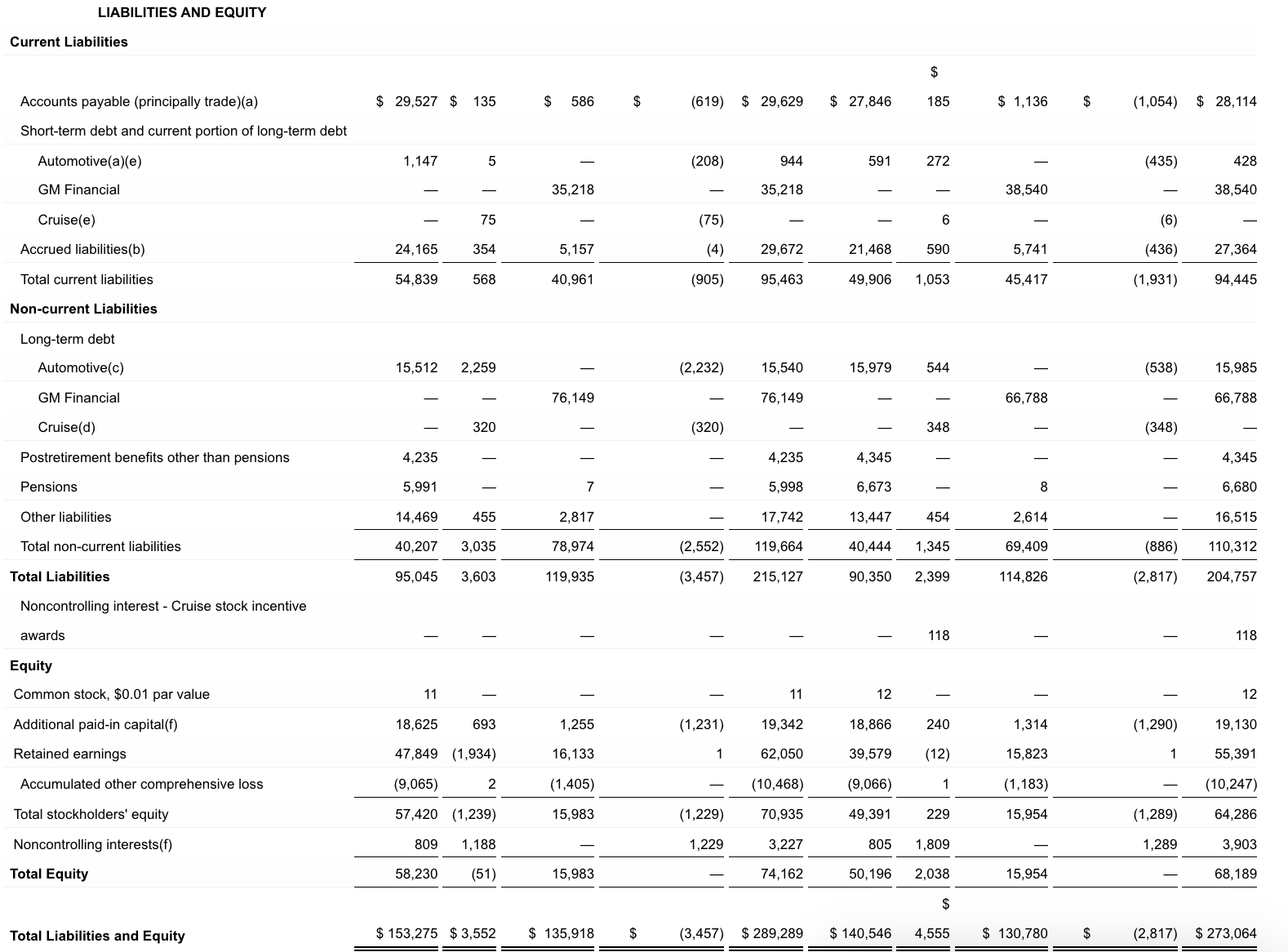

(a) | Eliminations primarily include GM Financial accounts and notes receivable of |

(b) | Eliminations primarily related to intercompany asset transfer between Automotive and Cruise for autonomous vehicle (AV) capital at |

(c) | Eliminations primarily related to convertible note issued by Cruise to Automotive at |

(d) | Eliminations primarily related to intercompany loans due from Cruise to GM Financial. |

(e) | Eliminations primarily related to GM Financial accounts receivables due from Automotive and Cruise. |

(f) | Primarily reclassification of GM Financial Cumulative Perpetual Preferred Stock, Series A, B and C. The preferred stock is classified as noncontrolling interests in our consolidated balance sheets. |

Supplemental Material1

(Unaudited)

These non-GAAP measures allow management and investors to view operating trends, perform analytical comparisons and benchmark performance between periods and among geographic regions to understand operating performance without regard to items we do not consider a component of our core operating performance. Furthermore, these non-GAAP measures allow investors the opportunity to measure and monitor our performance against our externally communicated targets and evaluate the investment decisions being made by management to improve ROIC-adjusted. Management uses these measures in its financial, investment and operational decision-making processes, for internal reporting and as part of its forecasting and budgeting processes. Further, our Board of Directors uses certain of these, and other measures, as key metrics to determine management performance under our performance-based compensation plans. For these reasons, we believe these non-GAAP measures are useful for our investors.

EBIT-adjusted (Most comparable GAAP measure: Net income attributable to stockholders) EBIT-adjusted is presented net of noncontrolling interests and is used by management and can be used by investors to review our consolidated operating results because it excludes automotive interest income, automotive interest expense and income taxes as well as certain additional adjustments that are not considered part of our core operations. Examples of adjustments to EBIT include, but are not limited to, impairment charges on long-lived assets and other exit costs resulting from strategic shifts in our operations or discrete market and business conditions, and certain costs arising from legal matters. For EBIT-adjusted and our other non-GAAP measures, once we have made an adjustment in the current period for an item, we will also adjust the related non-GAAP measure in any future periods in which there is an impact from the item. Our corresponding measure for our GM Financial segment is EBT-adjusted because interest income and interest expense are part of operating results when assessing and measuring the operational and financial performance of the segment.

EPS-diluted-adjusted (Most comparable GAAP measure: Diluted earnings per common share) EPS-diluted-adjusted is used by management and can be used by investors to review our consolidated diluted EPS results on a consistent basis. EPS-diluted-adjusted is calculated as net income attributable to common stockholders-diluted less adjustments noted above for EBIT-adjusted and certain income tax adjustments divided by weighted-average common shares outstanding-diluted. Examples of income tax adjustments include the establishment or release of significant deferred tax asset valuation allowances.

ETR-adjusted (Most comparable GAAP measure: Effective tax rate) ETR-adjusted is used by management and can be used by investors to review the consolidated effective tax rate for our core operations on a consistent basis. ETR-adjusted is calculated as Income tax expense less the income tax related to the adjustments noted above for EBIT-adjusted and the income tax adjustments noted above for EPS-diluted-adjusted divided by Income before income taxes less adjustments. When we provide an expected adjusted effective tax rate, we do not provide an expected effective tax rate because the

ROIC-adjusted (Most comparable GAAP measure: Return on equity) ROIC-adjusted is used by management and can be used by investors to review our investment and capital allocation decisions. We define ROIC-adjusted as EBIT-adjusted for the trailing four quarters divided by ROIC-adjusted average net assets, which is considered to be the average equity balances adjusted for average automotive debt and interest liabilities, exclusive of finance leases; average automotive net pension and other postretirement benefits (OPEB) liabilities; and average automotive net income tax assets during the same period.

Adjusted automotive free cash flow (Most comparable GAAP measure: Net automotive cash provided by operating activities) Adjusted automotive free cash flow is used by management and can be used by investors to review the liquidity of our automotive operations and to measure and monitor our performance against our capital allocation program and evaluate our automotive liquidity against the substantial cash requirements of our automotive operations. We measure adjusted automotive free cash flow as automotive operating cash flow from operations less capital expenditures adjusted for management actions. Management actions can include voluntary events such as discretionary contributions to employee benefit plans or nonrecurring specific events such as a closure of a facility that are considered special for EBIT-adjusted purposes.

![]() View original content:https://www.prnewswire.com/news-releases/gm-releases-2024-third-quarter-results-and-updates-full-year-guidance-302282403.html

View original content:https://www.prnewswire.com/news-releases/gm-releases-2024-third-quarter-results-and-updates-full-year-guidance-302282403.html

SOURCE

Jim Cain, GM Communications, 313-407-2843, james.cain@chevrolet.com; Ashish Kohli, CFA, GM Investor Relations, 847-964-3459, ashish.kohli@gm.com; David Caldwell, GM Communications, 586-899-7861, david.caldwell@gm.com