Houston Tax Expert Reveals 5 Essential Prep Tips for Tax Season

Francis Page Jr. | 1/29/2024, 3:57 p.m.

As tax season kicks off today, January 29, 2024, Jassmine Francis, CAA, Founder, and CEO of Houston’s Platinum Tax Service, offers invaluable insights to help individuals and businesses prepare effectively. Early preparation not only reduces stress but can also lead to potential cost savings before the April filing deadline.

With seven years of expertise in tax matters, Francis shares five essential tips to navigate the upcoming tax season smoothly, efficiently, and with the potential to maximize returns:

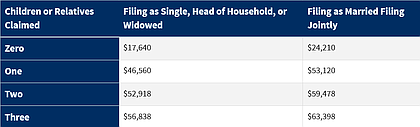

1. Earned Income Credit (EIC): EIC changes went into effect on January 24, 2024. Filers should be aware of the maximum Adjusted Gross Income (AGI), investment income, and credit amounts for the tax year 2023. The following are the income thresholds based on the number of children or relatives claimed:

Investment income limit: $11,000 or less

Maximum Credit Amounts:

No qualifying children: $600

1 qualifying child: $3,995

2 qualifying children: $6,604

3 or more qualifying children: $7,430

2. Self-Employment Expenses: Self-employed and small business owners should start gathering and organizing necessary documents now including bank statements, cash receipts, and canceled checks to claim expenses.

3. ROTH IRA: Consider opening a ROTH IRA – a special individual retirement account where contributions are taxed, but future withdrawals are tax-free. This strategy allows money to grow with interest without incurring taxes upon withdrawal. Additionally, you have until Tax Day to make IRA contributions for the prior year allowing you to contribute toward your 2023 tax year limit of $6,000 until April 15, 2024.

4. CD Savings: Explore Certificate of Deposit (CD) accounts, offering higher interest rates compared to regular savings accounts. With CDs, interest is earned, and when funds are withdrawn after the term, no taxes are incurred. Rates can range from 4-6% depending on the bank and term chosen.

5. Business Taxes: Knowing the type of business you have can save you a lot of headaches, mistakes, and time. Everyone should know the difference between an LLC, S-corp, and C-corp.

Limited Liability Company/LLC: is a business entity created by filing articles allowed by the state statue in the U.S. operated by members/owners that protects them from personal responsibility, debts, and liabilities. LLC can be filed as an S corporation or C corporation.

S Corporation/ S Corp: Shareholders of S corporations report the flow-through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates. This allows S corporations to avoid double taxation on the corporate income.

C Corporation/C Corp: A corporate income tax is first paid by a C-corp with a federal return (Form 1120S) required by the IRS. Shareholders must then pay taxes on personal income at the individual level for any gains from dividends or stock sale. This arrangement is referred to as “double taxation” because of the taxes levied on dividends at both the corporate and individual levels. C-corp shareholders are not allowed to write off corporate losses to offset other income on personal income statements.

Business taxpayers should not be issuing themselves a w2/w4 if they are not an S-corporation. All LLC/ C-corporations should pay themselves cash and claim business on their personal taxes.

S-corporations should be filing a Form 1120S first and then filing personal taxes using the form 1120S. S-corporations can issue themselves a w2/w4 form and pay themselves through the business.

Francis also advises individuals to find a qualified tax preparer well before the April filing date to ensure they are comfortable with the preparer, understand potential fees, understand what documents they will need to gather, and validate the person they choose has a preparer tax identification number (PTIN) to ensure they are authorized to prepare federal income tax returns.

For more tax tips and information, follow Platinum Tax Service @platinumtaxservice.