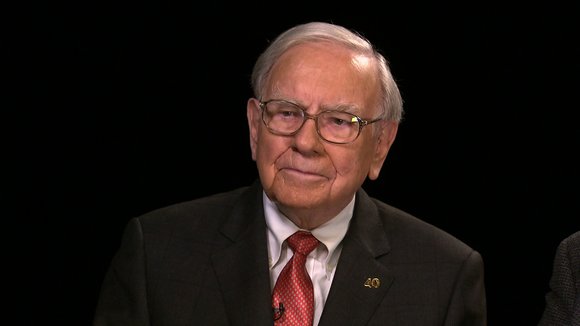

Warren Buffett Should Answer These 6 Key Questions

CNN/Stylemagazine.com Newswire | 5/2/2017, 3:20 p.m.

NEW YORK (CNNMoney) -- Are you ready for the so-called Woodstock of Capitalism? Warren Buffett will address tens of thousands of Berkshire Hathaway shareholders at the company's annual meeting in Omaha on Saturday.

And many more will be watching the festivities on their phones, computers or tablets thanks to a livestream of the event by Yahoo Finance. This is the second straight year that Yahoo will simulcast the event.

The shareholder meeting is always worth watching, even if you don't own a share of Berkshire stock -- either the affordable B shares that trade for $165 or the exorbitantly priced A shares that never split and sell for a whopping price of around $248,000!

If nothing else, consider it a fun way to spend your Saturday before downing some mint juleps while watching the Kentucky Derby!

Buffett and long-time Berkshire vice chairman Charlie Munger are likely to elicit numerous chuckles as they discuss their thoughts on the markets and economy and take questions from investors about the company, individual stocks and politics.

The two are kind of like a married couple who've been together for years, often telling (and laughing at) the same jokes.

But whether or not this is your first time tuning in to the Warren and Charlie show or if you're a grizzled veteran of Berkshire meetings, here are six things to keep an eye on for anyone, whether you're heading to Nebraska, or watching in sweatpants on the couch.

- Whither Wells? One of Berkshire's top holdings is the troubled bank Wells Fargo. The company has changed CEOs in the wake of the fake account scandal.

Berkshire owns about 473 million shares of Wells Fargo. Berkshire has been forced to sell a small position in Wells lately in order to keep its stake in the company below 10%, a limit set by the Federal Reserve for outside investors.

But some investors are surprised that Buffett hasn't been more critical of Wells. He famously talked about having no tolerance for hits to his company's reputation back in 1991, when talking to Congress about a scandal at investment bank Salomon Brothers.

Buffett told CNN's Poppy Harlow last November that he backs new CEO Tim Sloan and is still bullish on the bank's future.

Several shareholders have questioned Buffett about his ethics in the past few years. He's been taken to task for partnerships with private equity firm 3G, which has often laid off workers at companies it buys.

And some investors have expressed concerns about Berkshire's ownership of manufactured home Clayton, which has been criticized for its foreclosure practices, particularly for minority borrowers. Buffett has defended both 3G and Clayton repeatedly.

- Airlines lose altitude. Buffett turned some heads last year after Berkshire disclosed sizable stakes in four huge U.S. airlines -- United, Delta, American and Southwest. But this industry has recently come under fire for how it treats its customers.

United has had to apologize for dragging a passenger off a plane when he didn't want to be bumped from his flight. Delta was criticized for how it handled thousands of flight cancellations last month due to weather issues.

So Buffett is now backing another hard to love industry. Some investors may ask him if he still has faith in the sector and, more pointedly, whether he should continue to implicitly endorse the industry's bad behavior by owning the airline stocks.

It also doesn't help that he might have gotten in late. After years of benefiting from low fuel prices, rising fees and consolidation, there are now concerns the sector's profits may have peaked. Southwest is the only airline stock Buffett owns that is up this year.

- Trump bump? Buffett, a vocal backer of Hillary Clinton, was asked at last year's shareholder meeting if he was worried about what Trump would do to stocks if elected. Buffett sarcastically quipped that his portfolio would be the least of his concerns.

But Buffett has struck a more conciliatory tone since then, telling CNN's Harlow shortly after the election that he supports Trump - as he would any president. He even said he'd be happy to offer Trump advice if the president asked for it.

And so far, Buffett's portfolio has actually done quite well since Trump's victory -- thanks to hopes for tax reform and other pro-business policies.

Berkshire shares are up more than 12% since early November, slightly ahead of the broader market. So it will be interesting to hear what Buffett thinks of Trump now.

- Who's the next Berkshire CEO? Buffett will turn 87 in August. Munger is 93. News flash. Even if both will still be alive when Berkshire holds its 2027 annual meeting, there are valid questions over who will lead the company.

Buffett and Munger have already strongly suggested that Berkshire insurance guru Ajit Jain and energy chief Greg Abel are the front-runners for the CEO spot.

Investing lieutenants Ted Weschler and Todd Combs will likely continue to manage Berkshire's investments.

In other words, it will take multiple people to replace Buffett. So investors may want even more clarity about succession planning.

- iBuffett. Berkshire has a well-known Big Four group of stocks. Wells, IBM, Coke and American Express. Berkshire now owns a gigantic stake in Kraft Heinz as well.

But there's a sixth company that Berkshire has been busily scooping up shares of too -- Apple.

Apple accounts for about 5.5% of the Berkshire portfolio. Will Buffett continue to buy more? Could it one day move past AmEx into the top five of Berkshire's investments -- despite Buffett's friendship with Microsoft co-founder Bill Gates?

Buffett is well-known to be somewhat of a tech neophyte. So it will be interesting to see if any shareholders ask him for specific reasons why he likes Apple.

It could simply be a case that Apple, a market dominating company with a strong balance sheet and reasonable valuation, is too cheap to ignore -- even if Buffett doesn't spend his days posting Facebook updates and watching YouTube videos on an iPhone.

- More deals coming? Buffett loves to hunt for bargains.

In 2009, Berkshire has scooped up giant railroad Burlington Northern Santa Fe -- a purchase he dubbed an "all-in" wager on the U.S. economy.

Berkshire also first bought Heinz in 2013 and then merged that with Kraft in 2015. And Kraft Heinz tried (but failed) to convince Unilever to do a more than $140 billion deal earlier this year.

Berkshire also bought battery maker Duracell from Procter & Gamble in 2014. And in 2015, it did its biggest deal ever -- the $32 billion purchase of aircraft components maker Precision Castparts.

Buffett is likely not done shopping. He wrote in his annual shareholder letter that Berkshire has about $86 billion in cash that it could use for deals.

That has investors fantasizing about a mega acquisition that could top $100 billion. Expect Berkshire shareholders to try and get Buffett to name some of the potential targets on his wish list.

For more information go to http://www.cnn.com