What impact will US sanctions on Iran actually have?

CNN/Stylemagazine.com Newswire | 8/6/2018, 8:06 a.m.

Analysis by John Defterios, CNN

(CNN) -- Even before his shock win in 2016, US President Donald Trump was vocal in his criticism of the nuclear deal that the US, UK, France, Germany, Russia, and China signed with Iran in 2015.

Now that Trump has pulled out of the agreement to curb the country's nuclear program, the first wave of unilateral US sanctions to "snap back" -- or be reimposed -- on Iran takes force as of midnight Tuesday, with more to come later this year.

Tuesday's round of sanctions affects, among other things, the Iranian purchase or acquisition of US dollar banknotes and of gold and precious metals, and will also weigh on significant transactions in the Iranian rial and have an impact on the country's sovereign debt and its automotive industry.

What impact are they likely to have on the country and its population in the short and long term?

What are the most important sanctions snapping back at midnight?

While most of the world has been focusing on the sanctions on Iran's vast oil and gas reserves that will be reimposed in November, this first wave of sanctions will hit Iran's vulnerable economy harder than most are currently anticipating.

The collapse of the Iranian rial since Trump declared he would pull out of the nuclear agreement is the best economic indicator of the turbulence ahead.

Iran has been described as the "Germany of the Middle East," the last major emerging market to open fully to the outside world, with more than 80 million consumers, a highly educated population and an array of natural resources -- including precious metals.

The sanctions could torpedo Iran's efforts -- at least for the remainder of the Trump administration -- to realize its full potential.

Iran needs access to foreign currency and Washington is applying the full weight of the US Federal Reserve to block efforts by Tehran's new central bank governor to provide relief to Iran's exporters and importers. That clearly is the most challenging repercussion from the reimposition of sanctions by Washington.

Since Iran is such a large consumer market in its own right, it is a formidable industrial player in the Middle East and North Africa: a market of more than 300 million consumers, similar in population to the United States. These sanctions are designed to hit the country's steel, aluminum and auto sectors by limiting access to raw materials and essential parts.

Why is Iran's economy in a state at the moment?

The mere mention of the reimposition of US sanctions in recent months have undermined any momentum built up after the signing of the 2015 nuclear agreement.

After a recession in 2015, Iran's economy expanded by 12.5% in 2016 and carried on with solid growth the following year. Call it the post-sanctions boost.

Projections by the International Monetary Fund of over 4% growth this year were made well before the US pulled the plug on its role in the agreement.

The deal had sent European industrial giants racing in to sign a series of contracts worth billions of dollars, with names like Total, Peugeot, Renault, Airbus, Alstom and Siemens leading the charge.

But due to the weight of Wall Street -- both in raising capital for European companies and the level of US institutional shareholder investment -- they cannot subject their companies to the risk of secondary US sanctions.

Joe Kaeser, the chief executive of German industrial conglomerate Siemens, summed up the harsh realities of US economic influence during an interview with CNN in May after Trump walked away from the nuclear agreement. Kaeser said the company would stop all new deals in Iran.

"There is a primacy of the (US) political system. If that primacy is 'This is what you are going to do,' then that is exactly what we are going to do. We are a global company. We have interest and values and we have to balance both," said Kaeser.

What could the long-term consequences be?

Many believe the US wants to drive a wedge between Iran's leadership and the Iranian people with the potential goal of regime change, which Washington has denied.

The collapse of the rial is wreaking havoc on the average Iranian. Unemployment is shooting up, especially among the country's youth, inflation is spiraling higher because of the cost of imported goods, and there have been water and power shortages due to a lack infrastructure investment after years of on-again, off-again sanctions.

There have been sporadic protests in the capital Tehran and throughout the country that started late last year and have persisted ahead of the return of the sanctions.

In a political structure where the Supreme Leader, Ayatollah Ali Khamenei, attempts to balance the power of the perceived moderates in government and a hard-line military apparatus, President Hassan Rouhani will probably continue to take the public pressure.

Iran's parliament has called on Rouhani to answer questions about why more has not been done to buffer Iranians from the full force of US sanctions, since his American counterpart made crystal clear his intention to pull out of the accord.

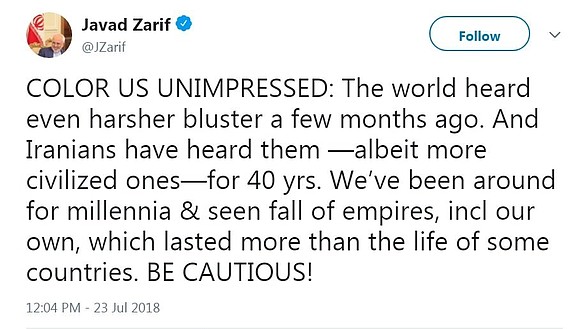

This no doubt will embolden the hardliners who have a high level of mistrust toward Washington, including the offer a week ago by Trump to hold talks with Tehran.

The hardliners would also have the most to lose if Iran were to open fully to the global economy, since their tentacles reach far and wide at all levels of the country.