What you'll see less of at CES this year: Chinese vendors

CNN/Stylemagazine.com Newswire | 1/7/2019, 3:09 p.m.

By Julia Horowitz and Samuel Burke, CNN Business

(CNN) -- In another sign of the strains between the American and Chinese business worlds, the countries' technology cold war has boiled over to America's largest tech trade show.

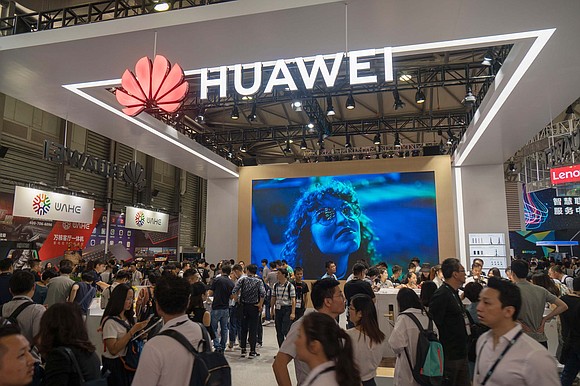

About 20% fewer Chinese vendors are at the 2019 CES expo than in previous years, a spokesman for CES said. ZTE isn't attending for the first time since 2011. Huawei's CEO delivered the show's keynote address in 2018, but no Huawei executives are speaking this year (Huawei still has a large booth at CES).

At the same time, fallout from tensions between the United States and China is a major theme of this year's show. The US-China trade war is slowing down business for companies from both countries, particularly startups and smaller businesses that don't have the supply chain flexibility of larger tech rivals.

For example, e-scooter and e-bike maker Jetson says it is using its presence at CES to meet with suppliers and talk with competition about moving its supply chain out of China to Vietnam.

"It'll definitely be on the agenda of every meeting we have," said Josh Sultan, Jetson's CEO. "10% to 25% tariffs are big numbers. They're going to affect not just the way we manufacture but the way that our consumers purchase the product."

The retrenchment of some Chinese companies at CES also follows a series of tough actions by the Trump administration, including a request to extradite Huawei's CFO and tough sanctions against ZTE.

And it notably comes amid a big battle between the United States and China over 5G supremacy. The next generation of wireless technology, which is expected to replace 4G-LTE in the next couple years, is a major topic of discussion at this year's CES.

Tension with Chinese companies

In December, Canadian officials arrested Huawei's chief financial officer, Meng Wanzhou, on behalf of the US government, accusing her of helping the company dodge sanctions on Iran. Meng, the daughter of Huawei's founder, was released on bail but cannot leave Canada until a judge rules on her extradition.

Meng's arrest sounded an alarm at Huawei, which is a vital part of China's efforts to become a global tech powerhouse. It sells more smartphones than Apple (AAPL) and builds telecommunications networks in countries around the world. But the US government believes Huawei is a national security risk.

Huawei denies that it is an agent of Chinese national intelligence, and it has repeatedly said it's unaware of any wrongdoing by Meng. The company insists it follows all the laws and regulations where it operates.

President Donald Trump added an extra wrinkle by suggesting he may intervene in American efforts to prosecute Meng, the chief financial officer of tech giant Huawei, if it would help his pursuit of a trade deal with China.

The legal battle with Huawei was preceded by the United States blocking ZTE from buying American technology parts in April 2018. Like Huawei, the Trump administration said that budget-phone-maker ZTE had lied to US officials about punishing employees who violated US sanctions against North Korea and Iran.

The export ban forced ZTE to halt almost all of its operations, putting the company's future in doubt — until the Commerce Department reached a deal with ZTE in June, agreeing to lift its ban after the company paid a $1 billion fine and put $400 million in an escrow account. ZTE also agreed to bring in an American monitoring team and overhaul its top management as part of the deal. It named a new CEO and replaced its entire board to meet US demands.

The Commerce Department said those measures were the "harshest penalties and strictest compliance measures ever imposed in such a case."

5G fight

The dwindling number of Chinese tech firms at CES will also underpin conversations about 5G technology, a big component of this year's show.

Verizon (VZ), CNN parent company AT&T (T) and other American wireless companies are racing to take the lead in 5G for consumers. But behind the scenes, Chinese champion Huawei is battling to power those 5G networks, coming up against US tech giants like Qualcomm (QCOM) and Intel (INTC).

The country that gets 5G networks up and running first will have a huge lead in hiring and investment, as well as a cache of valuable data from connecting all kinds of devices. For these reasons, China and the United States both view dominance in the 5G arena as a strategic necessity. China's five-year economic plan, which runs through 2020, calls for spending $400 billion on 5G technologies.

American companies are using the 2019 trade show as a platform for big 5G announcements, and may have a chance to steal the spotlight as Huawei takes a step back.

Ford (F) said Monday that all of its new vehicles will have the technology to "talk" and "listen" to other 5G-connected vehicles, as well as traffic lights and road signs, starting in 2022.

Both Qualcomm and Intel have a "significance presence" this year and are expected to provide 5G updates, according to Wedbush tech analyst Dan Ives. AT&T and Verizon will take the opportunity to highlight advancements in 5G tech for consumers, he added.

"With Huawei as one of the clear leaders in 5G and given [the] high stakes [of] US/China tensions, this year's conference will be all about unveiling the future of 5G," Ives said in a Monday note to clients.

Meanwhile, Huawei on Monday debuted a new chip geared toward the big data market in Shenzhen, where it's headquartered.