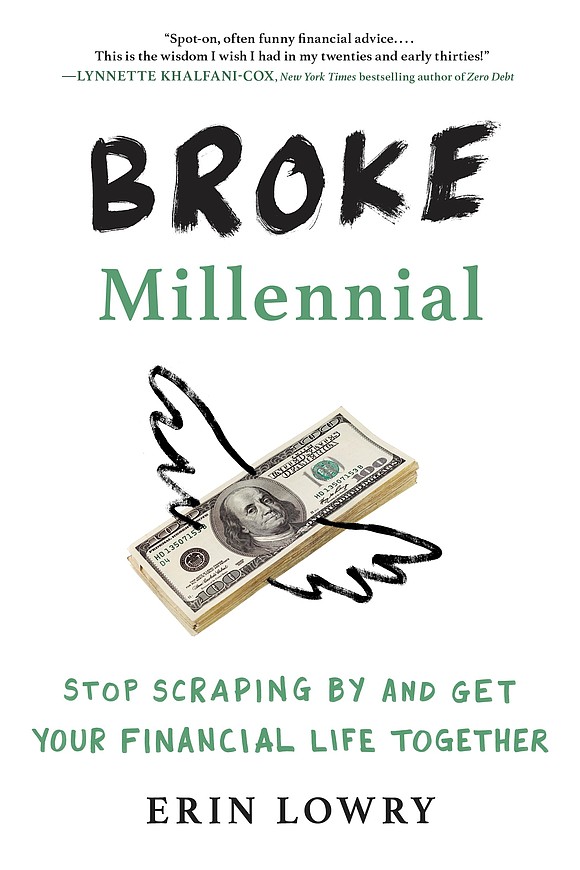

“Broke Millennial” by Erin Lowry

Terri Schlichenmeyer | 5/5/2017, 3:45 p.m.

You are so busted.

And that’s never a good thing in relationships, recreation, or in finances; especially in finances. When your wallet is empty, so are both calendar and stomach, but what can you do when even the word “money” scares you? With the new book “Broke Millennial” by Erin Lowry, you can be a dinero hero.

When she was a child, Erin Lowry’s parents practiced a sort of financial “tough-love” on their daughter, and it paid off: for Lowry, money has never been a taboo subject. It isn’t “stressful, confusing, scary,” like it is for many of her peers.

Money is just a thing, and it’s entirely possible, she says, to “set yourself up for the life you daydream about” by taking control of it. Start by understanding your attitudes toward money, acknowledging that your family plays a large part in how you use it, knowing the myths about finances, and erasing them from your mind.

If numbers make you numb, you’re in luck: there are only a few formulas you need to stay on top of your finances, Lowry says. Those formulas will help you see your debt, as a whole, which will help you know the pitfalls of credit, the difference between waived and deferred interest, why you should have a credit card, and why there’s only one way to use it. And yes, there’s an app for that.

Put yourself on a budget (a “Zero-Sum Budget” is excellent), so you can pay down debt and grow your savings. Know that “Pay Yourself First” is not just a cliché. Shop around for banks and credit cards because they’re not all alike. Think of your credit score and your credit report as your BFFs. Know how to invest and how to create a retirement account, even if retirement seems eons away. And know how to do the tough things, like asking for a raise, hiring a financial planner, getting a mortgage, and “getting financially naked” with your beloved SigO.

And what if you’re seriously in debt? Get out, with one of three methods that really work but be careful: scammers and spammers aren’t just online.

Fifteen bucks isn’t a lot of money. Then again, it might be if you’ve got an empty wallet and a full pile of debt. Still, it’s a price worth paying to own a helpful book like “Broke Millennial.”

In methods that are easy enough for a middle-schooler to try, author Erin Lowry explains nearly everything consumers need to know about finances, in layman’s terms and simple steps. The tone here is no-nonsense, and leaves hand-holding in the dust; indeed, readers aren’t coddled at all. Lowry says she’s “on a mission to stamp out financial illiteracy in our generation,” and her book does it, singlehandedly.

Best of all, though it’s meant for 20-somethings, this book isn’t specific to them: you really can give it to a wise middle-schooler or a grown-up in need of the info. For anyone old enough to read this book, “Broke Millennial” won’t be a bust.

c.2017, Tarcher Perigee $15.00 / $20.00 Canada 276 pages

Share this story online at www.stylemagazine.com.