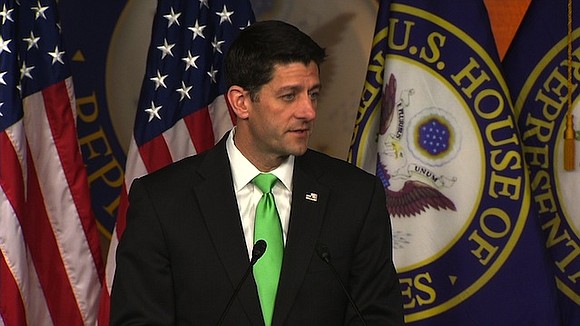

Paul Ryan's Tax Dream Is Coming True

CNN/Stylemagazine.com Newswire | 11/6/2017, 7:41 a.m.

By Lauren Fox and Phil Mattingly, CNN

(CNN) -- This is the moment House Speaker Paul Ryan has been waiting on for decades: The Republican Party is amid a massive rewrite of the US tax code that lowers rates and closes loopholes across the board.

This week, House Republicans will mark up their 429-page tax bill in the Ways and Means Committee, a process that is expected to be fraught with political posturing and take days to complete. And the real fight to ward off special interests, lobbying groups and every industry under the sun from derailing the tax bill is just getting underway.

But members say their speaker, the former chairman of the ways and means panel, is a "happy warrior," exuberant as he leads his party through a tax overhaul he's been talking about since he first landed on Capitol Hill in the early 1990s to work for Wisconsin Sen. Bob Kasten, a Republican who believed -- like Ryan -- that tax cuts were fundamental to spurring economic growth.

"He knows this as well as anybody," said Rep. Raúl Labrador, a Republican from Idaho and member of the conservative House Freedom Caucus. "I think this is great for him and it's an important moment."

When Ryan took the speaker's gavel in 2015 after John Boehner's untimely exit, he knew what he was giving up as ways and means chairman: a once-in-a-generation opportunity to rewrite the country's tax code in a vision that reflected that of his long-time mentor Jack Kemp.

As speculation swirled about whether Ryan would agree to take the job of speaker, Ryan was honest about his reluctance to give up his dream as top tax writer.

"I'm a policy guy, so I think I can do the most good for the country at ways and means," Ryan said in an emailed statement to The Washington Post in October 2015. "It's the job I always wanted, and it allows me to focus on the issues that are really important for our future."

He, of course, eventually acquiesced and was elected Speaker later that month. Two years later, with a Republican in the White House, Ryan, now gets a shot to re-write the tax code -- from the speaker's office.

'There's no question who the quarterback of this is'

Few quibble with the idea that Ryan and his top tax staffer, George Callas, hold major sway in the process. They have throughout the months of the "Big Six" negotiations and, according to several people involved in those talks, it's long been assumed that should either want to veto something, they'd have that power.

People involved in the process note that Ryan has been careful not to cut his chairman -- Rep. Kevin Brady of Texas -- off at the knees at any point. On the staff level, Brady's team has been responsible for writing -- and physically holding -- the language that now makes up the 429-page measure.

Ryan is playing a more behind-the-scenes role. And members say that while Ryan is undoubtedly an expert on taxes, the speaker is careful in closed-door conference meetings not to overshadow the current chairman, who served for years alongside Ryan on the committee and even lost the race to lead it in 2014 to Ryan.

"I think Ryan's been careful not to micromanage this bill and to leave it to the committee and certainly leave it to Chairman Brady, but at the end of the day if somebody's got to make a call above the chairman level -- and that happens in every bill -- that's what the speaker's role is," said Rep. Tom Cole, an Oklahoma Republican and ally of leadership's.

"We know who's running this show," Cole added. "There's no question who the quarterback of this is and that's the speaker, but the star running back is undoubtedly the chairman."

'If you haven't heard from them, that means it worked'

Still, there's a sense that when tough calls need to be made, it's Ryan who ultimately may have to pull the trigger, and Ryan who may be required to be the point person to assuage whichever constituency that decision ultimately infuriates.

It's part of the reason Ryan made a call to the National Association of Homebuilders to tell them that a credit they'd wanted would not be included in the House tax bill. Brady agreed as well, sources said -- but Ryan understood the magnitude of such a powerful interest declaring war on the House bill. While he couldn't keep Jerry Howard, the group's CEO, from talking to seemingly every media outlet in town about his displeasure, there have been dozens of other calls, to various outside groups and industries, that have been more successful.

The evidence? "If you haven't heard from them, that means it worked," one outside adviser notes.

But members across the conference know their speaker is a student of tax policy and keenly aware he's involved in the decision making.

Asked who was making the calls, Rep. Peter King, a Republican from New York who has concerns with the current tax bill said, "It's Ryan."

"It's been his dream for 25 years before he even came to Congress," King said.

Rep. Mark Amodei, a Republican from Nevada, was blunt in his assessment of the dynamic between Brady and Ryan.

"Listen, Kevin's a great guy and he's doing a hell of a job, but, listen, Paul Ryan is not a 'bottom up' guy," Amodei said.

Members of the House Ways and Means Committee who are closest to the process push back on speculation that Ryan is in the driver's seat.

"The Speaker has been very deferential to the Chairman," said Rep. Peter Roskam. "You have a big advantage in that you have a speaker who was a former chairman, so he's creating as much pathway as he possibly can and also an expectation of getting this on the President's desk. But that said, he's been very deferential."

Even in the policy itself, there are sections in the bill that aren't exactly what some expected to see under Ryan.

Whether it's the decision to maintain the top rate for high earners at 39.6% (something the Wall Street Journal editorial board called "a surrender to Democratic class warriors"), or expand the child tax credit ("a forlorn attempt to appease the income redistributionists of the right"), it's clear the bill moves in several directions that perhaps the Ryan of a few years ago wouldn't have chosen.

'This is a new experience for me to be excited about a bill'

Yet those additions are also clear nods to the era in which Ryan and Brady now find themselves -- the era of President Trump, who has made populist attacks a centerpiece of his policy platform and in several areas, sources involved in the process say, boxed GOP leaders in on taxes. They are also hemmed in by Senate rules and political realities -- the additions of the top tax rate and expanded credits make the bill a much easier political sell, both to the public and inside their conference, aides acknowledge.

But Ryan himself, when asked directly in an interview with CNN about the seemingly divergent themes of some of his past views on taxes and the bill itself, showed no hesitation.

"I'm excited about this tax bill," he said, going on to tout various pieces of the proposal. "I think this is a game changer for our economy."

At the end of the day, Ryan's legacy is as much wrapped up on the success of the tax bill as Brady's is. Now that the bill is written, the task of whipping and passing the bill falls to leadership.

After Senate Republicans failed to repeal and replace Obamacare this summer, GOP leaders are well aware that failing to deliver on tax reform could sink the party in the 2018 midterms. And, the will to do something has given Ryan some surprising allies in the conservative ranks.

On Friday, Kentucky Rep. Thomas Massie -- a congressman who voted against Ryan for speaker earlier this year -- told CNN he'd back the tax cut bill.

"I am going to vote for this," Massie said smiling. "This is a new experience for me to be excited about a bill."

House Republicans have laid out an ambitious timeline for the next few weeks. With the markup beginning Monday, House Republicans hope to have their bill on the House floor before Thanksgiving. Members acknowledge that Ryan will be a key to energizing the conference and making that happen.

"Having Paul as speaker, with his acumen for knowing the details of this policy -- he's been working on this for 20 years," said Rep. Tom Reed, a member of the House Ways and Means Committee. "This is his baby too."