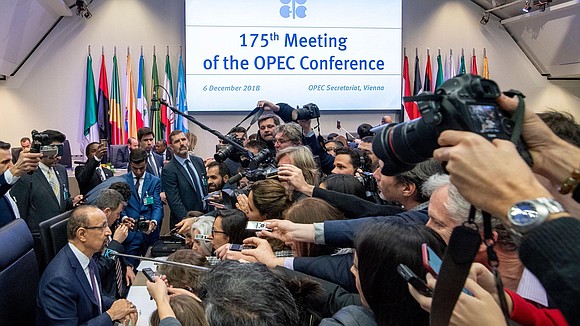

OPEC still debating oil production cut

CNN/Stylemagazine.com Newswire | 12/6/2018, 11:49 a.m.

By Zahraa Alkhalisi, CNN Business

(CNN) -- OPEC is still debating how much oil it should remove from world markets following a price crash in recent months.

Members of the oil cartel meeting in Vienna were ready to ignore President Donald Trump's repeated calls to keep output steady. But they were unable to conclude an agreement on Thursday, forcing the cancellation of a scheduled press conference. The scale of the production cut remains subject to debate that will continue Friday.

A senior OPEC delegate told CNN Business that members were trying to achieve a consensus to cut output by 1.3 million barrels a day. But OPEC's de facto leader, Saudi Arabia's energy minister Khalid Al-Falih, told reporters a cut on that scale might be "excessive" given a recent decision by Canada to scale back its production.

"The number that we need is going to be less than 1.3 [million] — is it a million, or slightly less, slightly more ... we have all day today, and some of tomorrow to determine the best number," Al-Falih said.

The Canadian province of Alberta announced last week it will pump 325,000 barrels a day fewer from January 1 because it is running out of space to store excess oil.

OPEC is seeking to stabilize oil markets after US crude prices plunged 22% in November, marking the the worst month since the global financial crisis in October 2008.

Analysts had said that a cut of around one million barrels per day would not be enough to balance the market in the first half of 2019, and oil prices fell again on Thursday.

Speaking after Thursday's talks, Al-Falih said he hoped to reach an agreement that would reduce production by around one million barrels per day. However, he told CNN Business' John Defterios that he wasn't "confident" a deal would be struck.

US crude oil was trading about 3.6% lower to $51 a barrel. It hit a four-year high above $76 in early October. Brent crude fell 3.2% to $59.60 a barrel.

The market is awash with oil. The United States is pumping at record levels and recently surpassed Russia and Saudi Arabia for the first time since 1973 as the world's largest producer.

Meanwhile, Iran is still selling crude despite American sanctions. The U.S. surprised OPEC and other producers by granting waivers to eight countries to continue buying Iranian oil after it reimposed sanctions in early November.

The International Energy Agency warned last month that supply is expected to exceed demand through 2019. In its November market report, OPEC said demand for its oil next year would be about 1.1 million barrels a day less than in 2018, and 1.4 million below current OPEC production.

Even if OPEC reaches an agreement, it will need to persuade Russia to cut production too. The alliance between OPEC and the world's second largest producer dates back to 2016, when they first agreed to cut production to halt a damaging price collapse.

The meeting with Russia is scheduled for Friday.