Dow falls as trade war jolts investors

CNN/Stylemagazine.com Newswire | 5/6/2019, 11:57 a.m.

By Matt Egan and Anneken Tappe, CNN Business

(CNN) -- Trade war fears have returned to Wall Street, wiping out a chunk of the stock market's recent surge.

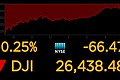

The Dow plunged 450 points at the open Monday morning after President Donald Trump surprised investors by threatening to impose higher tariffs on China in a late Sunday tweet. But at midday, the Dow bounced back from its initial low, and was down some 170 points.

The Dow is still up about 14% this year, but Monday's plunge at one point wiped out the past three weeks of gains.

The sudden escalation of US-China trade tensions deals a major blow to investors' expectations that Washington and Beijing would reach a trade deal in the near term. Trump's threats raise the risk of a prolonged fight between the world's two largest economies.

Heavy selling knocked the S&P 500 and the Nasdaq, which dropped 1.6% and 2.2% at the open. Just like the Dow, they retraced their initially losses, and were down 0.8% at midday.

For the year, the S&P remains 18% higher; the Nasdaq has gained about 22%.

The VIX, a market volatility index, jumped to its highest level since January.

"A big underpinning of the rally was this consensus that a trade deal with China would eventually get done," said Michael Block, market strategist at Third Seven Advisors. "This tweet may be a tactic but it has bulls unglued and playing what if."

World markets suffered even sharper losses as investors express concern about how tariffs and trade uncertainty will impact China's already-slowing economy. China's Shanghai Composite Index tumbled 5.6%, its worst one-day drop since February 2016, according to Refinitiv. The Shenzhen-based CSI 300 Index closed 5.8% lower. China's yuan dropped 0.8% against the US dollar in offshore trading. Hong Kong's Hang Seng dropped almost 3%.

"Shocking escalation — even on Trump standards," Chris Krueger, analyst at Cowen Washington Research Group, wrote in a note to clients on Sunday.

On Sunday, Trump threatened on Twitter to increase tariff rates on $200 billion in imports from China to 25%, up from 10% currently. The president said the increase would take effect on Friday.

Investors are unsure if Trump is trying to apply more pressure to Beijing to get a deal done quickly, or if he intends to carry through on his threat, market analysts said. Either way, the threat increases the risk that the trade deal could come undone.

The threat also has negative implications for the outlook of other trade spats, including autos and the passage of the the USMCA deal that is set to replace NAFTA, according to analysts at Goldman Sachs.

"His move injects major uncertainty into negotiations, which now face a rising risk of an extended impasse — perhaps even through the US presidential election," Michael Hirson, head of China and Northeast Asia at the Eurasia Group, wrote in a note on Sunday.

China signaled on Monday it still plans to attend upcoming trade talks in Washington.

The Goldman Sachs analysts said that while Trump's announcement "lowers the odds of a successful conclusion" to US-China trade negotiations, the firm thinks there is only a 40% chance that tariffs on China will go up on Friday.

"We believe an agreement is slightly more likely to be reached instead," Goldman Sachs wrote in a note to clients on Sunday.

Still, that represents quite the shift given the fact that US stocks had raced higher in recent months due in part to hopes of a US-China trade deal. The market's rebound was also driven by stronger economic reports and the Federal Reserve slamming the brakes on plans to raise interest rates.

"While the Fed's dovish policy pivot has been the biggest driver of the equity rally to date, future equity performance rests largely on optimism about a potential reacceleration and global economic and earnings growth in the second half," said Alec Young, managing director of global markets research at FTSE Russell. "Without a successful US-China trade breakthrough, it's much harder to be constructive on the global macro outlook."

The S&P 500 and Nasdaq hit record highs over and over again over the past weeks. All three major indexes have posted double-digit percentage gains this year, recovering sharply from the late 2018 plunge.

Renewed trade tensions could slow down US economic growth by creating uncertainty and raising costs on businesses and households.